🏡 Hot Plots for Sale – Regi Model Town Zone 1, Sector A2

Looking for top-class residential plots in Regi Model Town Peshawar? BSK Group brings you a fresh and limited-time listing of beautiful plots in Zone 1 – Sector A2, ready for sale at affordable rates.

This sector is known for its peaceful environment, direct access from main roads, and future potential in value. Now is the ideal time to invest before prices rise!

🏷️ Available Plots in Sector A2 – Zone 1

Here are our latest verified listings:

- 🔹 Plot 1A2-138 – Demand: 57 Lac

- 🔹 Plot 1A2-174 – Demand: 56.5 Lac

- 🔹 Plot 1A2-650 – Demand: 60 Lac

- 🔹 Plot 1A2-174 – Demand: 57 Lac

- 🔹 Plot 1A2-174 – Demand: 58 Lac

- 🔹 Plot 1A2-108 – Demand: 54 Lac

- 🔹 Plot 1A2-120 – Demand: 55 Lac

- 🔹 Plot 1A2-174 – Demand: 56 Lac

- 🔹 Plot 1A2-695 – Demand: 50 Lac

💥 These plots are ideal for construction or long-term investment, located in a developed part of Zone 1 with strong resale value.

Hot Plots for Sale in Regi Model Town – Zone 1, Sector A1

Looking to own a piece of prime real estate in Peshawar? This is your chance! BSK Group brings you a special opportunity to invest in Zone 1, Sector A1 of Regi Model Town (RMT) — one of the most promising and budget-friendly sectors available right now.

🌟 Why Zone 1 – Sector A1?

Zone 1 is among the earliest developed zones in Regi Model Town. Sector A1 stands out for its:

- ✅ Ready-to-construct plots

- ✅ Peaceful neighborhood

- ✅ Easy access to Ring Road and Hayatabad

- ✅ Fast-growing demand due to affordable rates

🏡 Available Plots in Sector A1 (Best Options)

Here are the most attractive options currently available through BSK Group:

- 🔹 Plot 1A1-719 – Demand: 35.5 Lac

- 🔹 Plot 1A1-299 – Demand: 45 Lac

- 🔹 Plot 1A1-636 – Demand: 40 Lac

- 🔹 Plot 1A1-308 – 🌟 Corner Plot – Demand: 55 Lac

- 🔹 Plot 1A1-299 – Demand: 44 Lac

- 🔹 Plot 1A1-139 – 🌟 Corner Plot – Demand: 55 Lac

- 🔹 Plot 1A1-719 – Demand: 36 Lac

💥 Whether you’re a builder, investor, or planning to build your dream home, these plots are priced to sell and located in a developed, secure zone.

📈 Why Invest Now?

⚡ Current prices are low — but expected to increase rapidly as development continues across RMT.

🏗️ Electricity and infrastructure works are pushing plot values upward.

📊 Sector A1 offers a great entry point for buyers looking for solid returns.

🏡 Regi Model Town Peshawar – The Hidden Gem of KPK Real Estate

Introduction: What is Regi Model Town (RMT)?

Regi Model Town, also known as RMT, is one of the largest and most well-planned housing schemes in Peshawar, developed by the Peshawar Development Authority (PDA). Located in the eastern part of the city, it connects seamlessly with Hayatabad, Ring Road, and DHA Peshawar.

With smart town planning, wide roads, residential serenity, and future potential — RMT is becoming the top choice for families and investors in 2025.

📌 Special Features of Regi Model Town

✅ Planned Zoning (Zone 1 to Zone 5)

✅ PDA-Approved & Legally Safe

✅ Modern Infrastructure: Wide roads, parks, and underground wiring

✅ Affordable Prices Compared to DHA or Hayatabad

✅ Strong ROI for Long-Term Investment

✅ Strategic Location Near Ring Road, Shaukat Khanum Hospital & University Road

✅ 5 Marla, 10 Marla, 1 Kanal & 2 Kanal plot options available

🗺️ Map & Location Advantages

📍 Main Access Points:

- University Road via Nasir Bagh Road

- Ring Road Interchange

- Adjacent to DHA Peshawar & Hayatabad Phase 7

🛣️ Location Benefits:

- Close to city & airport

- Ideal for people working in Peshawar city, Hayatabad, Karkhano, and universities

- Short drive to DHA, BRT station, and major hospitals

🏘️ Zones of Regi Model Town (Explained in Detail)

🔹 Zone 1 & Zone 2

- Early-developed but faced past land disputes

- Some parts are still under development

- Not the first choice currently, but may grow in future

🔹 Zone 3

- Developed and ready for possession

- Ideal for immediate construction

- Basic utilities and road structure complete

🔹 Zone 4

- Best for current investment in 2025

- Many houses constructed

- Rising population, parks, and markets in development

- Great resale value

🔹 Zone 5

- Hot investment zone!

- Wide roads, peaceful surroundings, modern construction starting

- Preferred by overseas Pakistanis

✅ Advantages of Investing in Regi Model Town

- 🏗️ Smart Urban Planning by PDA

- 💸 Affordable Plot Prices Compared to DHA

- 📈 High Return on Investment (ROI)

- 🛡️ Safe, Non-Disputed Property

- 🌳 Green Areas, Parks & Community Centers Planned

- 📍 Centrally Located in Peshawar

⚠️ Disadvantages / Challenges

- ❗ Zones 1 & 2 still face some legal and development delays

- 🔌 Electricity & gas connections in some areas not fully functional

- 🏢 Commercial zones still under development — may take time for full amenities

💼 BSK Group’s Role in Regi Model Town

At BSK Group, we specialize in property sales, consultation, and investment advisory within RMT. Our goal is to make your buying journey easy, transparent, and profitable.

🔹 Why Choose BSK Group?

- ✅ Access to verified plots in Zone 3, 4, and 5

- ✅ On-ground support for visits, verification, and legal checks

- ✅ Services for both local and overseas Pakistanis

- ✅ Trusted by 100+ happy clients in RMT and DHA Peshawar

📢 Special Note for Our Customers – The Best Time to Invest is NOW!

Currently, plot prices in Regi Model Town (especially in Zone 1) are available at highly attractive rates, ranging between PKR 50 to 60 lakh, with many great options in PKR 55 to 56 lakh as well.

👉 This temporary dip in prices is mainly due to ongoing electricity infrastructure work. However, once electricity and basic utilities are fully operational and construction activity picks up — plot values are expected to surge significantly, reaching PKR 1 crore to even 1.5 crore in the next phase.

✅ This is your golden opportunity to enter the market before prices rise. Smart buyers and investors are already securing their plots during this low-price window.

⏳ Don’t wait — invest now while the market is favorable and construction work is accelerating.

Let BSK Group help you lock the best plots at current rates, with full legal guidance and professional support.

Conclusion: Regi Model Town is the Future of Smart Urban Living in Peshawar

In a city where modern, secure, and affordable housing is in demand, Regi Model Town stands out as a rising star. With smart infrastructure, a great location, and growing interest from investors and families alike — this is your time to invest.

✨ Let BSK Group help you find the perfect plot in RMT — and build your dream life in the heart of Peshawar.

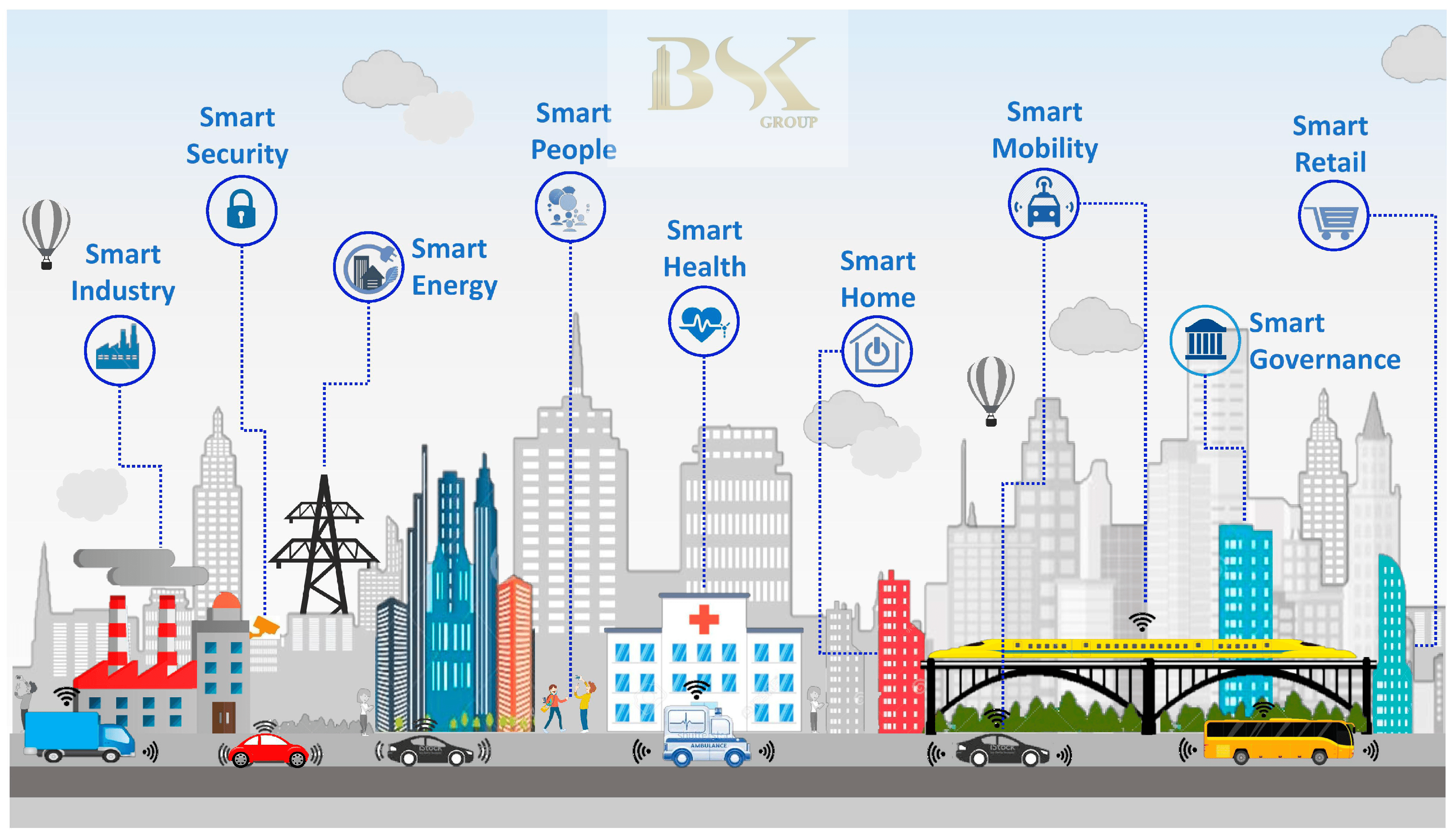

🏙️ The Rise of Smart Cities in Peshawar: Impact, Progress & BSK Group’s Role

Peshawar — once known purely for its history and tradition — is now rapidly transforming into a smart urban center, thanks to strategic planning, tech-driven real estate, and visionary projects. From Hayatabad and Regi Model Town to DHA Peshawar and the massive New Peshawar Valley, the city is embracing the smart city model like never before.

🧭 Urbanization Comes to Peshawar: A New Era of Living

Over the past decade, urbanization has accelerated across Peshawar. Better roads, access to education, healthcare, and commercial centers have pushed people to demand modern, secure, and smart living spaces.

💡 Key Drivers of Urbanization in Peshawar:

- Return of overseas Pakistanis investing in family homes

- Increased migration from rural areas into city suburbs

- Development of Ring Road and Bus Rapid Transit (BRT)

- Entry of real estate giants like DHA and KP Government in mega housing

This transformation is not just improving lifestyle — it’s changing the property investment landscape.

🏘️ Top Smart Housing Projects Leading the Change

✅ DHA Peshawar

- Secure, gated community

- Fiber-optic-ready infrastructure

- Smart security, parks, and community centers

- High ROI for both residential and commercial investors

✅ New Peshawar Valley

- Mega project by KP Government over 186,000 kanal

- Smart zoning, road networks, schools, and hospitals

- Designed as a future-ready smart city

- Huge potential for long-term appreciation

✅ Regi Model Town

- Planned town with sector divisions

- Wide roads and growing smart utility potential

- A rising option for mid-income buyers

✅ Hayatabad

- Already developed and evolving with modern upgrades

- Close to commercial hubs, hospitals, and Ring Road

📈 Impact of Smart Cities on Peshawar’s Real Estate Market

🌟 Property Prices Surge: Smart zones are experiencing rapid price appreciation.

🌍 Attraction for Overseas Buyers: Expats now trust modern projects in Peshawar.

🔐 Secure Living: People are shifting from unregulated areas to secure, planned housing.

🚀 Business Growth: Smart housing boosts retail, construction, tech, and service sectors.

🏢 BSK Group – Leading the Way in Smart City Investments

At BSK Group, we are proud to be part of Peshawar’s smart transformation. Our mission is to help buyers make informed, secure, and profitable investments.

💼 What We Offer:

- Expert consultancy in DHA Peshawar, New Peshawar Valley, and Regi Model Town

- On-ground support for property visits and booking

- Assistance for overseas clients via digital platforms

- Transparent deals with complete legal guidance

Whether you’re a first-time buyer or a seasoned investor, smart living is the future, and Peshawar is the next big hub. With mega projects developing and modern infrastructure unfolding fast, this is the best time to secure your place in a smart city.

💬 Still confused about where to invest?

Let our expert team at BSK Group guide you through the process — from selection to secure ownership. We turn real estate into real value.

📍 Contact Us Today

🏢 Office Location:

BSK Marketing Group & Investment Services

Main Office: Basaharat Market Hayatabad Phase 3 Peshawar KPK

📞 Phone / WhatsApp: +92 3062499868

👤 CEO / Property Advisor: Nizam Ullah Marwat

Iran hits back with missile and drone strikes after Israel attacks nuclear sites

The U.S. says it wasn’t involved in the strikes on Iran, but three American officials told NBC News the U.S. is assisting in shooting down Iranian missiles and projectiles targeting Israel.

The Israeli military launched a massive attack on Iran on Friday in a dramatic escalation of their long-running conflict that drew a retaliatory missile assault from Tehran and raised the risk of another war in the Middle East.

The Israeli strikes took out a significant swath of Iran’s top military leaders and senior scientists, as Israel unleashed more than 200 fighter jets across roughly 100 targets. They were aimed at Iran’s main enrichment facility and targets associated with the country’s ballistic missile program, Israeli Prime Minister Benjamin Netanyahu said.

In a firm response Friday evening local time, Iran launched missiles toward Israel, the nation’s defense forces said, prompting its highly sophisticated defense systems to “intercept the threat.

Heavy smoke appeared in the night sky over Tel Aviv as incoming rockets from Iran descended on the city, with many intercepted by Israel’s missile defense systems. Before the retaliatory attack began, the Israel Defense Forces directed residents across the country to remain close to protected spaces, minimize movement in public areas and avoid public gatherings.

Police officers and bomb disposal experts responded to reports of fallen projectile debris, according to the Israeli Police, which advised people to report “suspicious findings” to an emergency hotline.

Israel’s emergency service, Magen David Adom, said it was providing medical treatment to 34 injured people following a rocket strike in Israel’s central region.

The Israeli paramedic organization also said it was providing treatment and evacuating at least 21 people after a strike south of Tel Aviv.

Iran later launched a fresh wave of missiles in the early hours of Saturday morning local time, Israel Defense Forces said.

A Tel Aviv hospital treated seven people with injuries following the early morning attack, The Associated Press reported.

Israel’s strikes have killed 78 people so far, including senior military officials, and injured 320 people, according to Iranian ambassador to the United Nations Ali Bahreini. Residential buildings were among the structures damaged in Tehran.

Loud explosions in Iran were heard in the northern part of the capital on Friday night, while state media reported attacks in Qom, located south of Tehran and a holy city for Shia Muslims. Fars reported on X that explosions could be heard in the area of the heavily fortified nuclear site of Fordow, which is located deep underground near Qom.

Supreme Leader Ayatollah Ali Khamenei swiftly vowed retaliation, telling his nation in a televised address Friday evening local time that Israel would be punished.

Air defense systems were activated in central Tehran, home to Khamenei’s compound and presidential office, reported the Iranian semiofficial Mehr news agency.

Soon after the strikes, Iran launched more than 100 drones toward Israel, Israeli Brig. Gen. Effie Defrin said. The Israel Defense Forces said it was attacking missile launchers and unmanned aerial vehicles launched from Iran, and a military spokesman said on X that strikes were conducted on the nuclear plant in Isfahan in central Iran.

Iran has long denied that it is seeking to develop nuclear weapons.

The United States, which had been publicly urging Israel to hold off on such an attack as the Trump administration continues talks with Tehran on its rapidly advancing nuclear program, said it was not involved in the strikes on Iran and was not assisting with the attacks.

But three U.S. officials told NBC News later Friday that the U.S. is assisting in shooting down Iranian missiles and projectiles targeting Israel. The Pentagon moved a number of military assets into the region in recent days, including Navy destroyers to be positioned off the Israeli coast to help shoot down missiles and other aerial attacks expected after the Israelis launched their initial attack, according to another U.S. official.

President Donald Trump told NBC News in an interview Friday he was pleased with the manner in which the strikes were conducted.

“They had the finest equipment in the world, which is American equipment,” he said.

According to a U.S. official, Trump and Netanyahu spoke Friday.

The International Atomic Energy Agency, the United Nations’ nuclear watchdog, earlier said Iranian authorities had confirmed Natanz, Iran’s largest nuclear site in Isfahan, had been struck but that there was no increase in radiation levels observed there.

Defrin confirmed that Israel struck an underground area of Natanz that targeted critical infrastructure linked to its continued functioning and “inflicted significant damage on this site.”

Other targets appeared to be residential compounds for top military officials. A main building for Iran’s Islamic Revolutionary Guard Corps (IRGC), founded in the aftermath of the 1979 Islamic Revolution to defend the regime against internal and external threats, also appeared to have been attacked and could be seen burning on state television.

Among those killed in Israel’s strikes was Mohammad Hossein Bagheri, Iran’s most senior military official, multiple Iranian state news outlets reported. Bagheri, who was chief of staff of the Iranian armed forces, had a status equivalent to that of Qassem Suleimani, the commander of Iran’s secretive Quds Force who was assassinated by the U.S. in a drone strike in Baghdad in January 2020.

The Shahid Beheshti University in Tehran said in a statement on Telegram that at least five professors from the school’s community had been killed, including nuclear scientist Mohammad-Mehdi Tehranchi. It said some family members of professors were also killed, but did not share their identities or further details.

Authorities seal outdated brick kilns in Islamabad

Islamabad: In a recent crackdown on outdated brick kilns, the Pakistan Environmental Protection Agency (Pak-EPA) initiated a targeted operation to curb air pollution in the Islamabad Capital Territory (ICT). The action focused on sectors H-16 and H-17, where several non-compliant brick kilns were found violating environmental regulations.

During the operation, authorities sealed five illegal brick kilns that were still using the outdated Fixed Chimney Bull Trench Kilns (FCBTKs) method—an environmentally harmful process known to contribute significantly to smog and deteriorating air quality in Islamabad. These kilns had failed to adopt the eco-friendly zigzag technology, which is now mandatory under new environmental standards aimed at improving air quality and promoting sustainable brick production practices.

This Islamabad brick kiln crackdown is part of broader efforts by Pak-EPA to enforce clean air policies and encourage the adoption of zigzag technology across Pakistan. The move is seen as a crucial step in smog control and reducing harmful emissions from traditional brick manufacturing processes.

Read: Pairs Plots No. 803/804 in DHA Peshawar

According to Mohammad Saleem Shaikh, spokesperson for the Ministry of Climate Change and Environmental Coordination, the sealed brick kilns had already been served multiple warnings and directives to shift to zigzag technology—an energy-efficient and eco-friendly brick kiln technology aimed at reducing harmful emissions and improving air quality in Islamabad. Despite repeated notices, the operators continued using outdated methods, prompting strict enforcement under the Pakistan Environmental Protection Act, 1997.

“These outdated brick kilns were not only violating environmental laws but also posed severe health risks and environmental hazards to nearby communities,” Saleem stated during the Islamabad brick kiln crackdown.

Pak-EPA Director General Nazia Zeb Ali reinforced the agency’s zero-tolerance stance against non-compliant practices. “We will continue strict implementation of environmental regulations. Any violators contributing to air pollution in Islamabad or ignoring the shift to sustainable technologies like zigzag will face serious consequences,” she affirmed.

Read: پاکستان اور ہندوستان کے طلباء کی مشترکہ آواز

She further stated that the Islamabad brick kiln crackdown is part of a larger clean-air initiative aimed at encouraging sustainable industrial practices across the capital. As part of this ongoing effort, the Pakistan Environmental Protection Agency (Pak-EPA) has been strongly advocating for the adoption of zigzag kiln technology—a modern method that arranges bricks in a zigzag pattern to enhance airflow, boost fuel efficiency, and drastically reduce emissions.

The enforcement action followed numerous public complaints and detailed field inspections conducted by Pak-EPA teams. This operation reflects the agency’s renewed commitment to improving air quality in Islamabad by regulating outdated industrial methods and ensuring compliance with environmental laws.

Pairs Plots No. 803/804 in DHA Peshawar – A Golden Investement Opportunity for PTI Lovers and Smart Investors

If you’re looking to make a *secure, symbolic, and profitable investment, then this is the opportunity you’ve been waiting for. **BSK Group, a trusted name in real estate, is now offering a *1 Kanal residential pair plot (Plot Numbers *803 and 804) in the prestigious *Sector A of DHA Peshawar.

This isn’t just any real estate deal — Plot No. 804 carries a powerful connection with none other than *Imran Khan, the former Prime Minister of Pakistan and the leader of **Pakistan Tehreek-e-Insaf (PTI). For many PTI supporters and patriotic Pakistanis, *804 is more than a number — it’s a symbol of belief, change, and future hope.

Let’s explore why this plot is the best opportunity in 2025 for both smart investors and PTI lovers.

✅ Why Pairs of Plots No. 803/804 is Special for PTI Supporters?

Imran Khan’s election campaign and movement brought forward a sense of revolution and patriotism in the country. Among his loyal supporters, 804 has been widely associated as his “golden number” — a sign of inspiration and dedication to a better Pakistan.

Now imagine owning Plots No. 803/804 in DHA Peshawar — a place that already symbolizes modern, secure, and luxurious living — and combining it with the legacy of Imran Khan. It’s *not just an investment, it’s a *statement of your belief and your vision.

For PTI fans, this is an emotional and once-in-a-lifetime opportunity to own a piece of land that resonates with their heart.

🏡 About the Plots: 803 and 804 – Sector A, DHA Peshawar.

- 📍 Location: Sector A – The heart of DHA Peshawar

- 📐 Size: 1 Kanal (Pair Plot – 803 & 804)

- 🏠 Type: Residential

- 🔒 Security: Gated community with DHA-level safety

- 🛣 Access: Wide roads, near to parks, schools, commercial areas

- 📈 Investment Potential: High demand zone, strong ROI expected

This is not just about owning a home. This is about living in a prestigious address that will only grow in value with time.

Why DHA Peshawar?

DHA Peshawar has rapidly become the most talked-about housing society in KPK. Backed by the Defence Housing Authority (DHA), this project promises:

- High-quality infrastructure

- Strong resale and rental market

- Prime location with excellent connectivity

- Secure and organized community

- Appreciation in property value over time

If you are from KPK, or even from anywhere in Pakistan or abroad, DHA Peshawar is your best bet for real estate growth in 2025.

💼 BSK Group – Your Trusted Partner in Real Estate

We, at *BSK Group, are proud to offer this exclusive opportunity directly from our office located at *Basharat Market, Hayatabad, Peshawar. Our team is experienced, professional, and passionate about helping you find the right property that matches both your goals and values.

We don’t just sell plots — we provide value-driven investment solutions.

🎯 Who Should Invest?

- ✅ PTI Supporters who want to own a symbolic piece of land

- ✅ Overseas Pakistanis looking for a secure and meaningful investment

- ✅ Real estate investors seeking high ROI with low risk

- ✅ Families planning to build their dream homes in a peaceful environment

📞 Book Now – Limited Plots Available

Golden opportunities don’t last forever, and this one is moving fast! If you want to secure Plot No. 804 (and 803) in DHA Peshawar, act now.

📞 Contact Us: 0306 2499868

📍 Office: Basharat Market, Hayatabad Peshawar

🏷 Offered by: BSK Group

🛑 Status: Available Now – Booking Open

Conclusion

DHA Peshawar Sector A is already a dream for many. But Plot 804 takes this dream one step further by combining premium location, top-notch development, and a number that speaks directly to PTI followers and believers in Imran Khan’s vision.

Whether you’re investing for yourself or the next generation, this plot offers emotional value, financial strength, and patriotic pride.

👉 Own the golden number. Own Plot No. 804. Own your future.

تعلیم سے ترقی، جنگ سے تباہی: پاکستان اور ہندوستان کے طلباء کی مشترکہ آواز

امن اور تعلیم: ہمارا مشترکہ خواب

پاکستان اور ہندوستان کے نوجوانوں کے دلوں میں ایک ہی خواہش ہے: پڑھ لکھ کر اپنا اور اپنے ملک کا مستقبل بہتر بنانا۔ یہ ہمارے درمیان واحد مشترکہ نعرہ ہے: ‘تعلیم سے ترقی، جنگ سے تباہی’۔ ہم اس خواب کو حقیقت بنانا چاہتے ہیں۔ ہمارے حکمران برسوں سے یہی کہتے آئے ہیں کہ دشمن سے لڑائی ضروری ہے، لیکن ہمیں تو صرف اسکولوں میں بیٹھ کر کتابیں پڑھنی ہی ہیں، نہ کہ ہتھیار اٹھا کر لڑنا۔ ہمیں اسکولوں کی گھنٹیوں کی آوازیں سننا اچھا لگتا ہے، توپوں کی گرج نہیں۔

تعلیم: ترقی اور روشن مستقبل

تعلیم وہ روشنی ہے جو عام کا طریقہ دکھاتی ہے اور ہمیشہ کے لئے انسان کو ایسا راستہ دکھاتی ہے جو اسے ترقی کی طرف لے جاتا ہے۔ جب ہم سکول اور کالج میں بیٹھ کر علم پر دسترس ہوجاتے ہیں تو ہماری سوچ میں وسعت پیدا ہوتی ہے اور زندگی کے مشکلوں کا حل ملجاتا ہے۔ ایک پڑھا لکھا نوجوان ڈاکٹر، انجینئر یا م. بن کر اپنی اور اپنے گھر والوں کی تقدیر بدل سکتا ہے اور پورے اج کی خدمت کر سکتا ہے۔ دنیا کے ترقی والے ممالک اپنی ترقی کا راز یہی بتاتے ہیں کہ انہوں نے تعلیم کوجانب پر پہلی پہنچ دی۔ ہماری ملکوں کے بھی نوجوان اس روشنی کو دیکھتے ہیں اور ملک کی ترقی میں اپنا کردار ادا کرنا چاہتے ہیں۔

جنگ: تباہی کی یاد

صرف تباہی اور بے چنی ہی لاتا ہے جنگ۔ ہمیں کوئی کچھ نہیں ملے گا: صرف ملبے، موت اور غربت کے بوجھ۔ جب گولے برسے تو ہمارے اسکول ڈھائے گئے، پل ٹوٹ گئے اور ہسپتال ملبے کا ڈھیر بن گیا۔ لاکھوں خاندان کچھ گھٹیے نکل گئے اور پوری نسل نفرت کے زخم لے کر جوانی کی رازقی پیل سے کاٹ کر آگئی۔ پچھلی کئی جنگوں کے بعد ہمارا معاشرہ کہیں پیچھے چھوٹ گیا۔ ترقی کی رفتار رک گئی اور خوف کے سائے پھیل گئے۔ ہمیں واضح ہو چکا ہے کہ جنگ کا انجام صرف تباہی ہوتا ہے۔ ہمیں اس سے کوئی فائدہ نہیں ہے ملتا۔

یورپ اور امریکہ کی ترقی کا راز

دنیا کے ترقی یافتہ ممالک – جیسا کہ یورپ اور امریکہ – نے امن اور تعلیم کو اپنی ترقی کا راز بنایا۔ جنگ عظیم دوم کے بعد یورپی یونین نے تنازعات کے بجائے بات چیت اور تعاون کو اپنا ترجیح دیا اور اپنی نئی نسلوں کو تعلیم سے آراستہ کیا۔ امریکہ نے بھی اپنے طلباء کو اعلیٰ تعلیم دی اور سائنسی تحقیق میں بھاری سرمایہ کاری کی، جس کی وجہ سے آج وہ دنیا کی جدید ٹیکنالوجی اور روزگار کے مواقع فراہم کرتے ہیں۔ ان ممالک کی ترقی کا راز یہی ہے کہ انہوں نے تعلیم اور امن کے ذریعے ترقی کو فروغ دیا۔ ہمیں بھی اپنے ملکوں میں ترقی کے لیے انہی اصولوں کو اپنانا ہوگا۔

پاکستان اور ہندوستان: میرا

پاکستان اور ہندوستان کے عوام بھی امن اور ترقی کے مستحق ہیں۔ ہمارے نوجوان ہنرمند ہیں اور ہم بھی اپنے ملکوں کو اعلیٰ مقام پر دیکھنا چاہتے ہیں۔ ہمیں بھی وہ مواقع اور وسائل ملنے چاہئیں جو امریکہ اور یورپ کو حاصل ہوئے۔ ہمارا بھی حق ہے کہ ہمارا بچہ اسکول میں پڑھے، جنگوں کے محاذ پر نہیں۔ ہمیں یقین ہے کہ جب بھی ہمیں علم اور امن کا ماحول فراہم کیا جائے گا، ہمارا ملک بھی دنیا میں اپنی الگ پہچان بنا لے گا۔

حکمرانوں سے سوال

کیا حکومت عوام کو ترقی نہیں دے رہی؟ دفاع ضروری ہے لیکن کیا ملکی طاقت صرف ہتھیاروں میں پوشیدہ ہے؟ پورا بجٹ دفاعی سازوسامان پر لگ جاتا ہے لیکن عوام کے اسکولوں میں فنڈز نہیں ہیں۔ ہمارا ہر بچہ اسکول میں پڑھنا چاہتا ہے، مگر حکومت ہمیں بھاری ٹینک دکھا رہی ہے۔ آخر کیوں؟ عوام تعلیم اور انصاف چاہتے ہیں، لیکن حکمران انہیں نظر انداز کر کے جنگ کے دلدل میں الجھائے ہوئے ہیں۔

امید کی کرن

آخر میں، ہم سب عہد کرتے ہیں کہ ہم مل کر اس نعرے کو حقیقت میں بدلیں گے: ‘تعلیم سے ترقی، جنگ سے تباہی’۔ ہمیں یقین ہے کہ امن اور تعلیم ہی ہمارے ملکوں کا روشن مستقبل ہیں۔

ہم سب اپنا کردار ادا کر سکتے ہیں:

- تعلیم کو اولین ترجیح دیں۔ اپنے خاندان کے بچوں کو اسکول بھیجیں اور خود بھی علم حاصل کرتے رہیں.

- امن کا پیغام پھیلائیں۔ اپنے دوستوں اور گھر والوں سے بتائیں کہ ترقی میں امن اور تعلیم کی اہمیت ہے۔

- حکومت سے مطالبہ کریں۔ تعلیمی بجٹ بڑھانے اور غربت کے بجائے امن و ترقی کو ترجیح دینے کا مطالبہ کریں۔

- دوستی کو فروغ دیں۔ پاکستانی اور ہندوستانی نوجوانوں میں میل جول بڑھائیں اور علمی و ثقافتی تبادلے کریں۔

- اس بلاگ کو دوسروں کے ساتھ شیئر کریں تاکہ ہمارا پیغام دور تک پہنچ سکے۔

Safe and Profitable Investment For Afghan Investors – BSK Marketing Group Plan

A Golden Opportunity to Invest in Pakistan – Your Capital is Safe, Profits Are Guaranteed!

Given the current political and economic situation in Afghanistan, many Afghan investors are looking to invest their wealth in a safe and stable economy. Pakistan, especially Peshawar, is an excellent investment destination where you can make safe, legal and profitable investments.

BSK Marketing Group has brought you a unique and safe investment plan, through which you can earn a steady income by investing in plots, ready-made houses, high-rise flats, or commercial properties.

BSK Group Safe Investment Plan

The plan consists of three major investment models, which take into account different financial needs and priorities.

1- High-Rise Apartment Investment in Peshawar

Excellent opportunity for investors looking for rental income or secure housing.

🔹 Project Details:

✅ Investment opportunity in modern and privately guarded high-rise apartments in the best locations of Peshawar.

✅ 1, 2 and 3 bedroom apartments available, with modern amenities and premium locations.

✅ Get a steady income every month by renting out the flat.

✅ Investors can profit by selling their property at any time.

✅ It is also a safe and sustainable housing solution if you want to live on your own.

🔹 📌 Benefits:

✔ Monthly rental income – Capital is safe and profit is consistent.

✔ Increase in real estate value – The price of the apartment will increase over time.

✔ Premium location – Modern amenities and a great living environment.

✔ Easy buying and selling – You can sell your property whenever you want.

2- Investing in Houses in Peshawar

For those who want to own their own home immediately or earn income by renting it out.

🔹 Project Details:

✅ Modern ready-made houses available in DHA Peshawar, Regi Model Town, and Hayatabad.

✅ Available in all sizes: 5 Marla, 10 Marla, 1 Kanal and more.

✅ Buy today, shift tomorrow! No additional construction time.

✅ Get a steady income by renting out if you don’t need a residence.

🔹 📌 Benefits:

✔ Immediate ownership – The convenience of shifting as soon as you buy a home.

✔ Rental income – Profit from your investment every month.

✔ Long-term investment – The value of homes increases over time.

✔ Safe and legal investment – BSK Marketing Group will provide legal protection.

3- Invest in Plots & Developments in Peshawar

For investors who want to earn more profit by buying land.

🔹 Project Details:

✅ Plots available in DHA, Regi Model Town, Hayatabad and other prime locations of Peshawar.

✅ Buy a plot and build it yourself or get it built with the help of BSK Marketing Group.

✅ Commercial or residential plot, both opportunities available.

✅ Plot prices are increasing rapidly, this is one of the safest investments!

🔹 📌 Benefits:

✔ Low cost investment – Land value increases over time.

✔ Build and Sell Model – Buy land, build, and sell to earn profit.

✔ Hassle-free investment – We will take care of your plot.

✔ Safe and Legal Investment – All transactions will be transparent and legal.

Contact us today!

If you or an Afghan investor you know is looking for safe, legal and profitable investment opportunities in Pakistan, BSK Marketing Group is here for you!

📍 BSK Marketing Group, Basharat Market, Hayatabad, Peshawar

🌐 Website: www.bskgroups.com

📞 Contact Number: +92 306 2499868

📩 Email: bskmarketinggroup@gmail.com

Safe Investment in Pakistan for Afghan Investors: A Guide by BSK Marketing Group

Are you an Afghan investor eyeing Pakistan? The economic ties between Afghanistan and Pakistan are getting stronger. More Afghan investors are looking to Pakistan for opportunities. What’s driving this? It’s a mix of history and current events.

BSK Marketing Group is here to help. We are your trusted guide. We’ll help you find safe, profitable investments in Pakistan. Safety and growth are our goals.

Understanding the Pakistani Investment Climate

Pakistan’s economy has its ups and downs. But some areas are doing well. It’s important to know what’s happening. This is where your investment could grow.

Current Economic Overview

Pakistan’s economy is growing. We see it in the GDP growth. Even inflation rates are a factor. Foreign direct investment (FDI) is also a key indicator. Sectors like real estate are booming. Agriculture shows promise. Technology is on the rise, too. These all present solid returns for savvy investors.

Government Policies and Regulations

The government wants foreign investment. They have laws to protect investors. You can even send profits back home. There are also tax breaks. These incentives make Pakistan more attractive.

Identifying Safe Investment Sectors in Pakistan

Some sectors are more stable than others. They offer better security. As an Afghan investor, this matters. We’ll focus on proven sectors.

Real Estate Opportunities

Real estate is often a safe bet. Cities like Islamabad are great. Lahore and Karachi also have potential. You can invest in houses or commercial buildings. Property values can go up. This creates nice returns.

Agricultural Investments

Agriculture is important in Pakistan. There’s room to grow here. Think about crops or livestock. Agricultural processing is another option. The government supports agricultural investments.

Technology and Startup Ventures

Pakistan’s tech scene is growing fast. Startups are popping up. Fintech is hot. E-commerce is booming. Software development is strong. The government is pushing for more tech investments.

Due Diligence and Risk Management for Afghan Investors

Before you invest, do your homework. Know the risks. Take steps to lower them.

Legal and Financial Considerations

You need to register your business. Know the rules. Understand currency exchange rates. Learn about taxes. Banking regulations matter, too.

Partnering with Local Experts

It helps to have local partners. Lawyers can guide you. Accountants are useful. Consultants know the market. BSK Marketing Group can connect you with these experts.

BSK Marketing Group: Your Partner for Safe Investments

BSK Marketing Group is a reliable partner. We have the expertise you need. We’ll guide you to safe investments.

Our Expertise and Services

We offer market research. We advise on investments. We provide legal support. We can manage your projects. We’ve helped many clients succeed.

📞 Contact Us!

If you or an Afghan investor you know is looking for a safe investment opportunity in Pakistan, contact us today!

📍 BSK Marketing Group, Basharat Market, Hayatabad, Peshawar.

🌐 Website: www.bskgroups.com

📞 Contact Number: 03062499868

📩 Email: bskmarketinggroup@gmail.com